Marginal Cost Of Funds Meaning

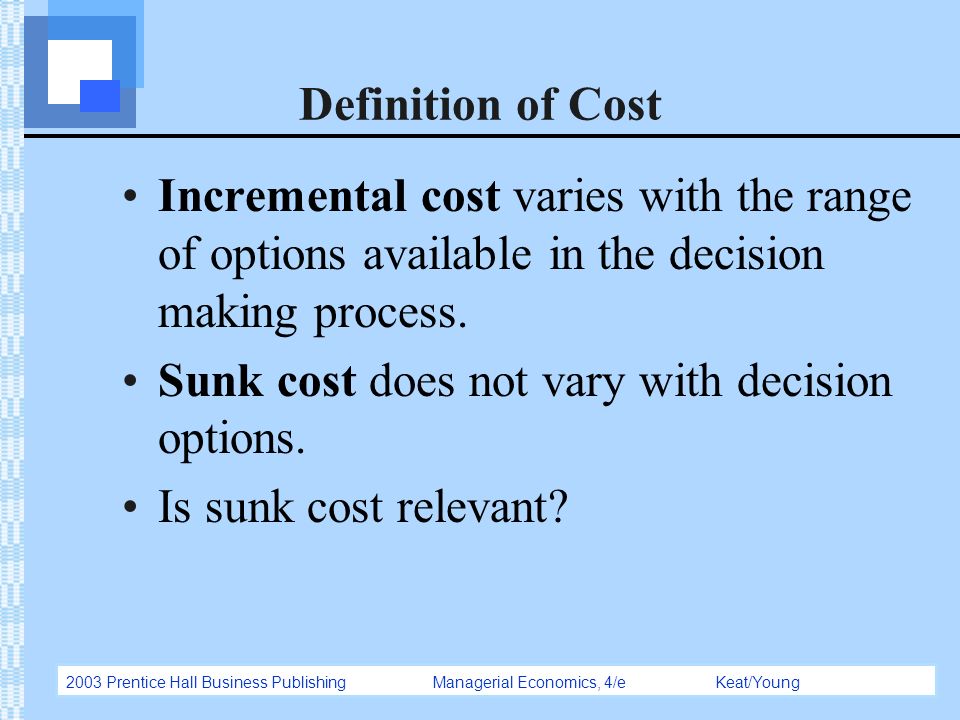

As an incremental cost or.

Marginal cost of funds meaning. The marginal cost of funds based lending rate mclr refers to the minimum interest rate of a bank below which it cannot lend except in some cases allowed by the rbi. Marginal cost this is the cost charged on the interest rate given on term deposits savings and current account etc. The marginal cost that is the novel element of the mclr. According to the rbi the marginal cost should be charged.

The cost of funds is one of the most important input costs for a. The marginal cost of public funds mcf is a concept in public finance which measures the loss incurred by society in raising additional revenues to finance government spending due to the distortion of resource allocation caused by taxation. Cost of funding one additional loan assuming that the bank s cost of funds remains the same. Operating costs incurred by the banks tenor premium which is the higher interest that can be charged for long term loans.

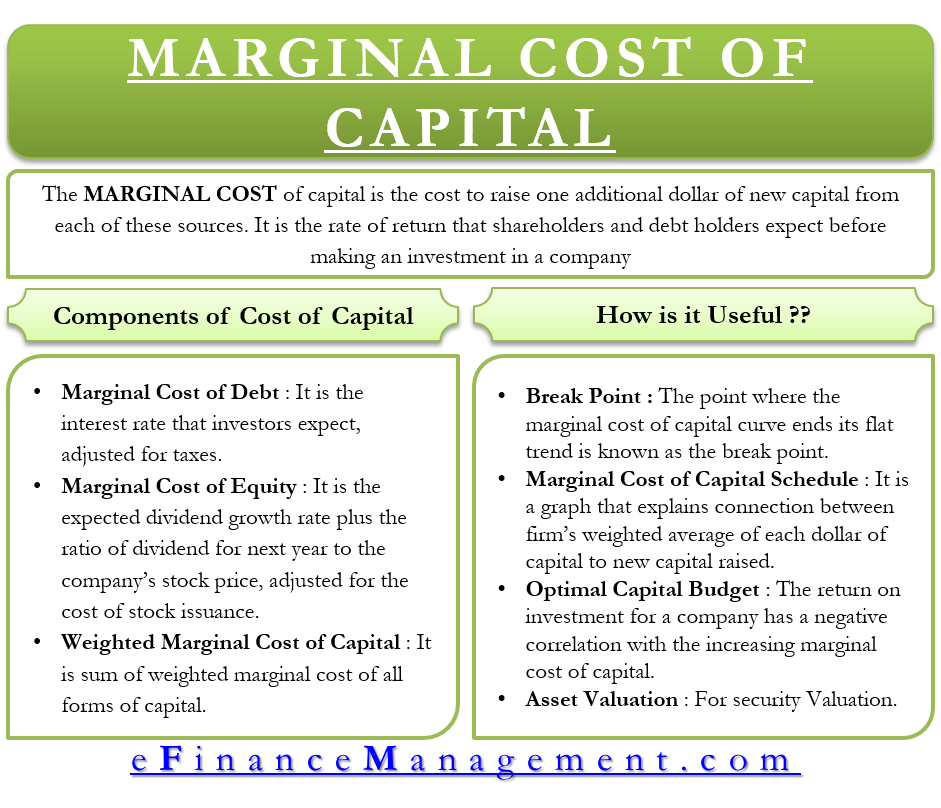

Marginal cost of funds which comprises of marginal cost of borrowings and return on net worth negative carry on account of cash repo rate which is the cost banks incur to keep reserves with rbi. It is an internal benchmark or reference rate for the bank. The marginal cost of funds will comprise of marginal cost of borrowings and return on networth. The term marginal cost of funds refers to the increase in financing costs for a business entity as a result of adding one more dollar of new funding to its portfolio.

The cost is also charged on the borrowings and return on net worth. Definition of marginal cost of funds.