Net Asset Value Per Share Formula Grade 12

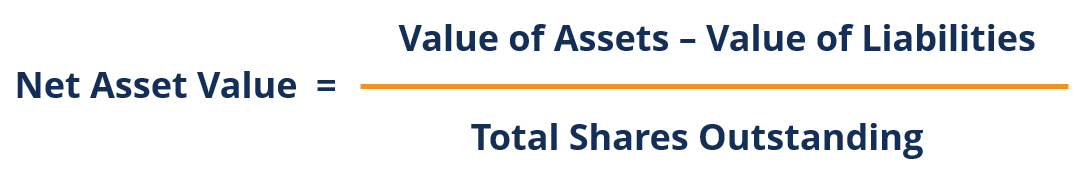

The net asset value is determined by the mutual fund company and priced according to this formula.

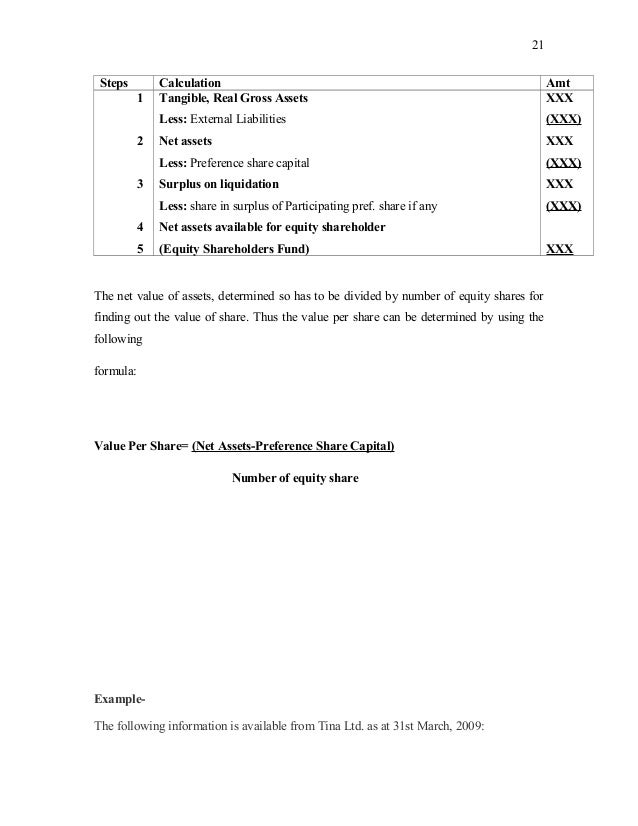

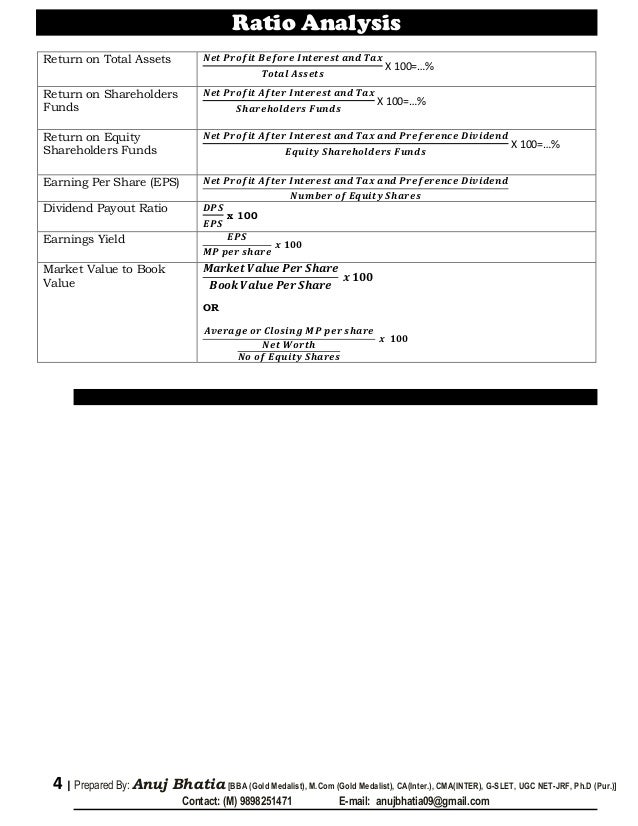

Net asset value per share formula grade 12. Equity ratio in your answer 6 1 5 should the shareholders. Discuss the difference between a drawing and. Nav is commonly used as a per share value calculated for a mutual fund etf or closed end fund. The nav on a per share basis represents the price at which investors can buy or sell units of the fund.

Net asset value total asset value expense ratio number of outstanding units where total asset value is the market value of the investments of the mutual fund latest closing price on the relevant stock exchange in addition to any accrued income and receivables less accrued expenses outstanding debt to creditors and other liabilities. Using office supplies as an example discuss the difference between an expense and an asset. The formula for net asset value only looks at the fund s per share value based on its net assets. He wrote the books on value investing security analysis and the intelligent investor.

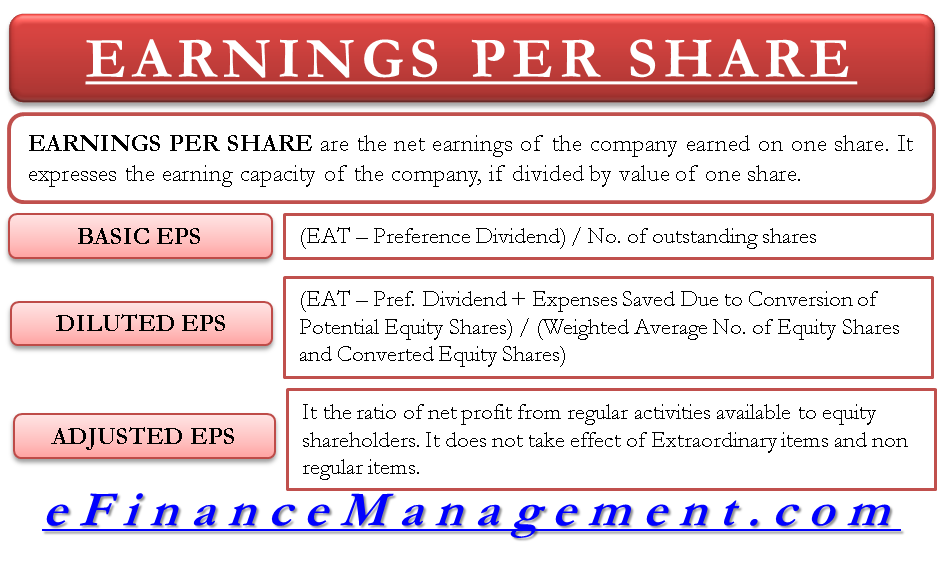

Net income on a per share basis is referred to. Net asset value per share 2010 3 5 3 1 4 comment on world champion limited s use of the mortgage loan. Value september 03 2020 14 96 september 02 2020 19 58 september 01 2020 22 16 august 31 2020 20 99 august 28 2020. Net asset value per share navps is an expression for net asset value that represents the value per share of a mutual fund an exchange traded fund etf or a closed end fund.

Stock and bond valuation methods are not used due to mutual funds being sold directly from the company and not through an exchange or on the secondary market. Refer to appropriate financial indicators and the debt. When the value of the securities in the fund increases the nav increases. Book value per share is also used in the return on equity formula or roe formula when calculating on a per share basis.

It is calculated. Roe is net income divided by stockholder s equity. Net asset value is the value of a fund s assets minus any liabilities and expenses.