Non Cumulative Preference Shares Definition

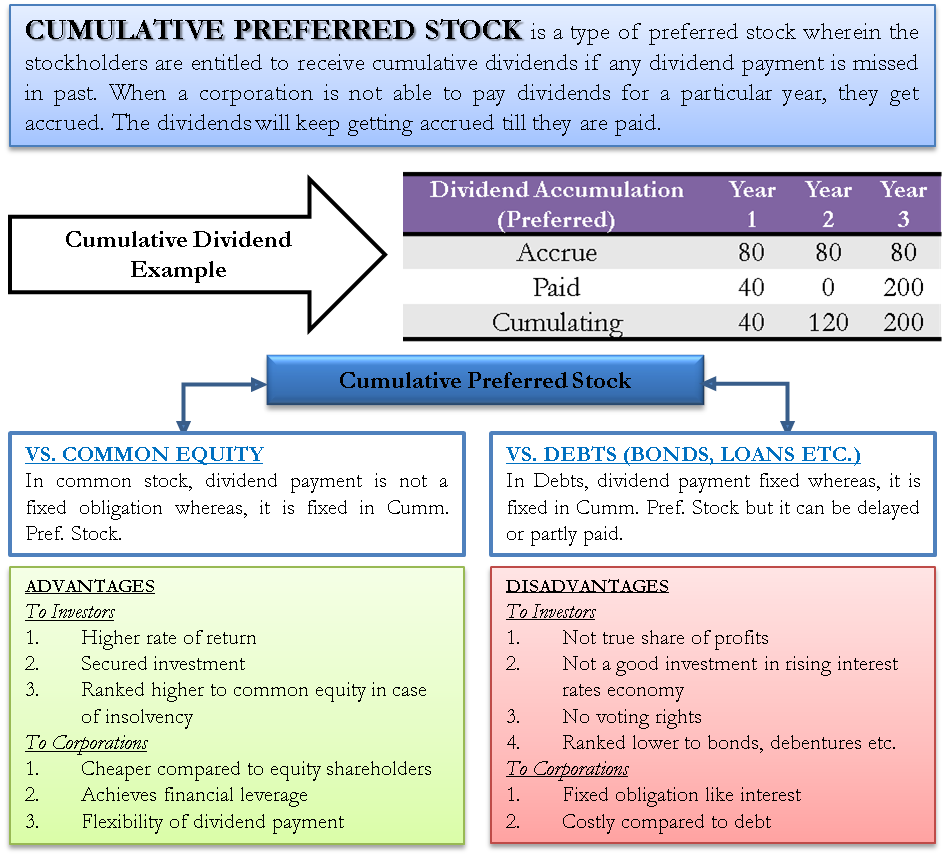

Most preferred stock is cumulative preferred stock.

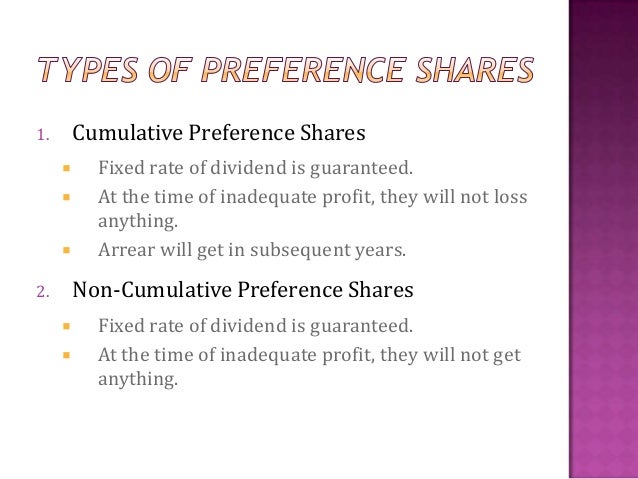

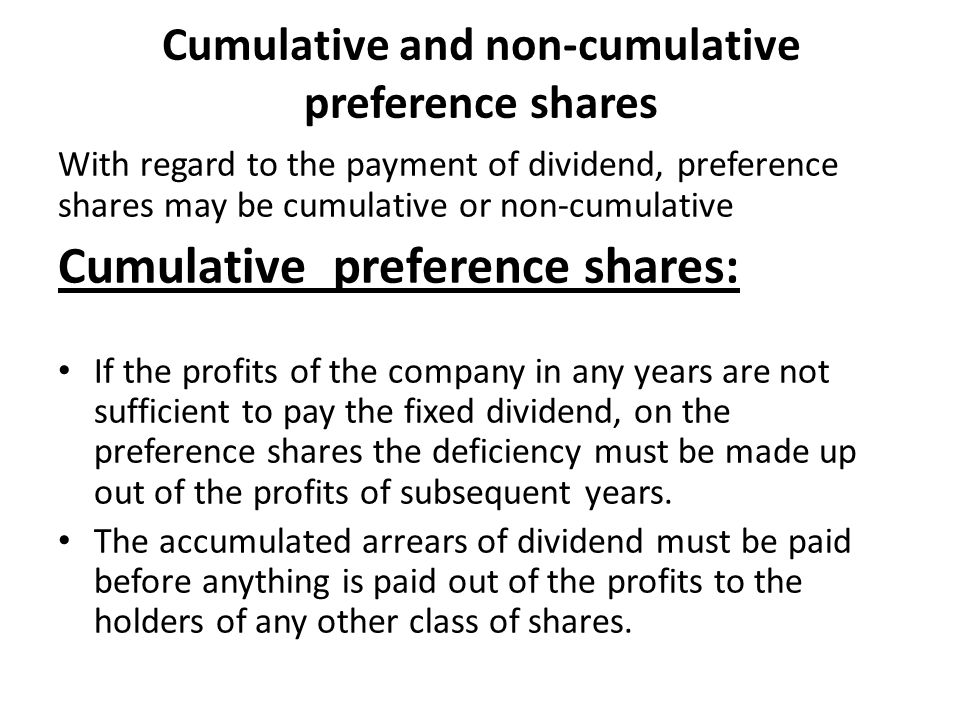

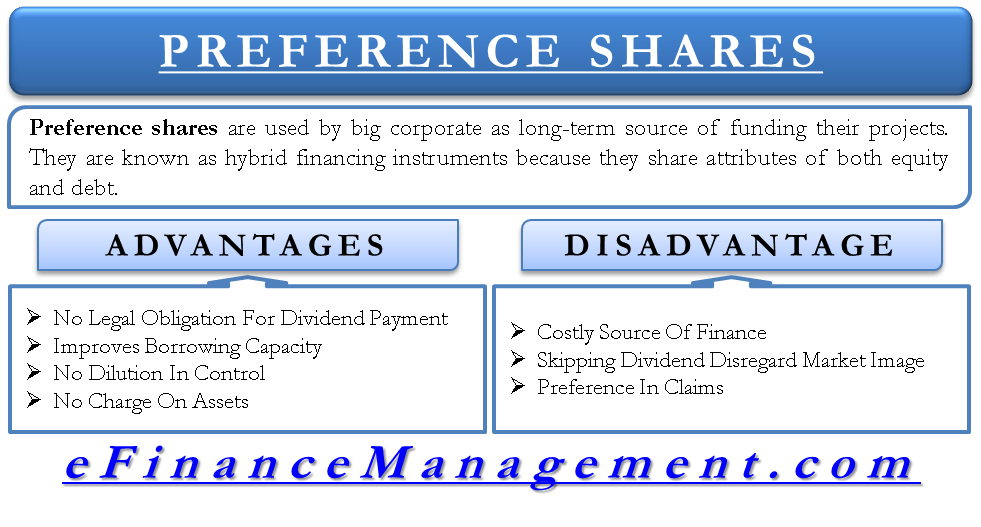

Non cumulative preference shares definition. Non cumulative preference shares are those shares that provide the shareholder fixed dividend amount each year from the company s net profit but in case the company fails to pay the dividend on such preference share to the. Most preferred stock is cumulative preferred stock. Noncumulative preferred stock is extremely rare because it places the holders of the stock in the uncertain position of not having an assured income stream. Cumulative preference share definition.

Instead the shares are effectively the same as common stock where. If a company issuing shares decides not to pay dividends and you have cumulative preferred shares you are entitled to receive these past dividends. If they are non cumulative this means that if a. A preference share which will have the dividend paid at a later date even if the company is not able to pay a dividend in the current year note the us term is cumulative preferred stock related terms.

However if you own non cumulative preferred. In addition aspen has said that its board of directors has declared a dividend on its newly issued 5 625 percent perpetual non cumulative preference shares the board has declared a dividend of usd191 40 per share equivalent to. A preference share is a share which is entitled to a fixed dividend payment and no dividend can be paid to ordinary shareholders before a dividend is paid to preference shareholders. This contrasts with non cumulative preferred stock for which stockholders must forgo dividend payments that are missed.