Ns I Guaranteed Income Bonds Interest Rates

Guaranteed income bonds 1 year 1 20 gross 1 21 aer 1 05 gross 1 06 aer 15 basis points guaranteed income bonds 2 year 1 40 gross 1 41 aer 1 15 gross 1 16 aer 25 basis points 3 year 1 65.

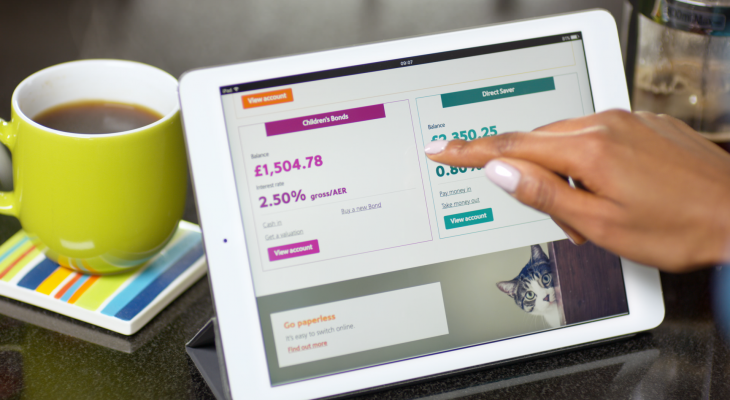

Ns i guaranteed income bonds interest rates. Ns i said customers holding guaranteed growth bonds guaranteed income bonds and fixed interest savings certificates and whose investments mature on or before 1 june 2020 and who automatically. Its one year growth bonds are being cut from 1 25 per cent to 1 1 per cent. Guaranteed growth bonds one year 1 25 1 1 guaranteed growth bonds two years 1 45 1 2 guaranteed growth bonds three years 1 7 1 3 guaranteed growth bonds five years 2 1 65 guaranteed income bonds. Guaranteed growth bonds 3 year term issue 58 1 95 gross aer guaranteed for 3 years 10 000 11 june 2018 guaranteed income bonds 1 year term issue 63 1 45 gross 1 46 aer guaranteed.

1 15 gross 1 16 aer we calculate the interest daily and add it to your bank account on the 5th of each month or the next working day if the 5th is a weekend or bank holiday. Ns i guaranteed income bonds term length old rate new rate if renewing after 5 october one year 1 45 1 2 two year 1 65 1 4 three year 1 9 1 65 five year 2 2 1 95. One year ns i s growth bonds and fixed interest savings certificates pay interest annually and its income bonds monthly. Here s what you need to do next what you need to decide if you decide to renew an existing bond on or after 1 may 2019 you won t be able to cash it in before.

The changes to our fixed term products are as a consequence of a number of factors. Ns i income bonds what is the interest rate.