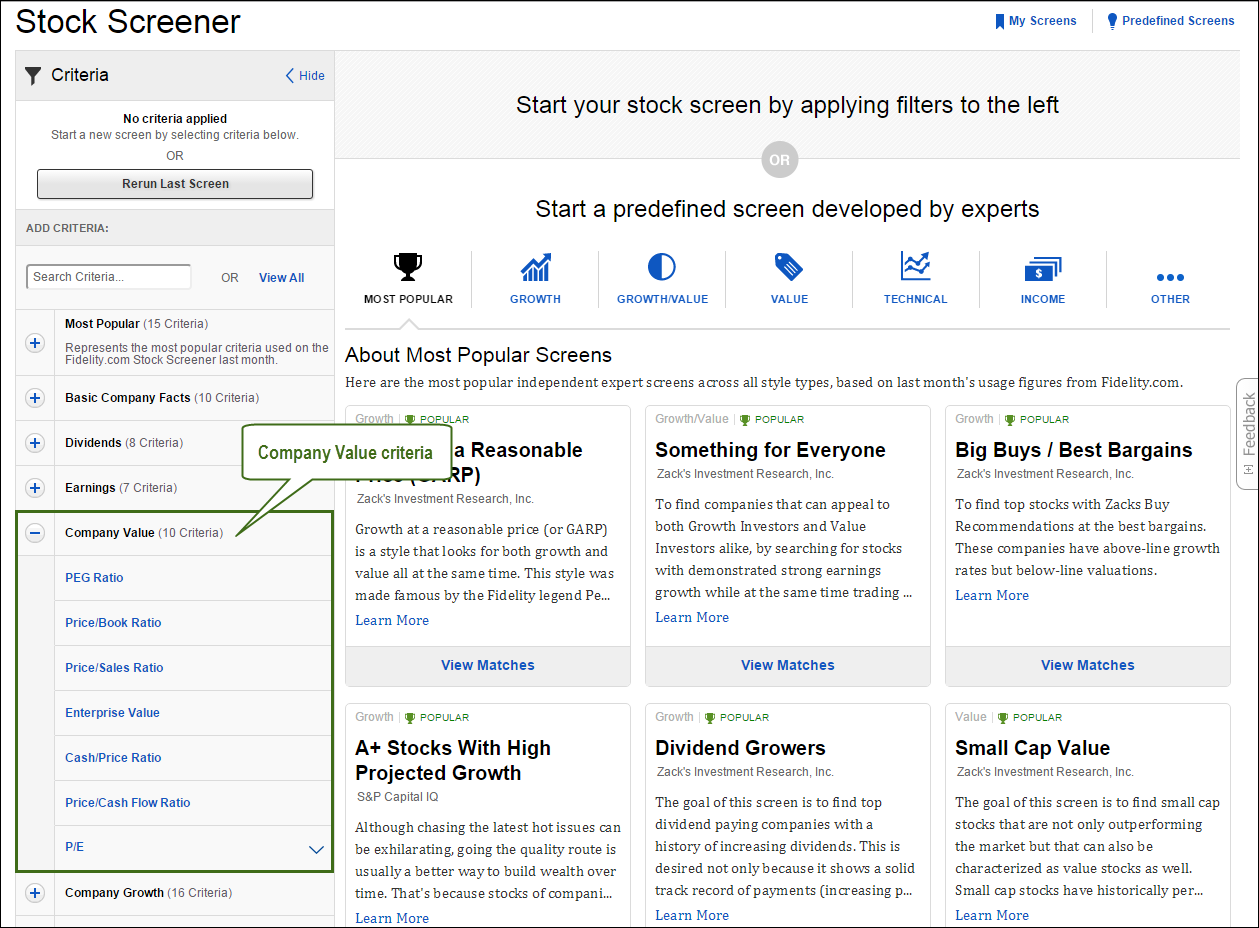

Price To Book Ratio Meaning

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg)

Book value usually located on a company s balance sheet as stockholder equity represents the total amount that would be left over if the company liquidated all of its assets and repaid all of its liabilities.

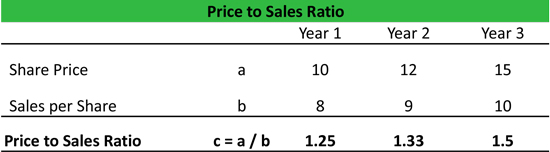

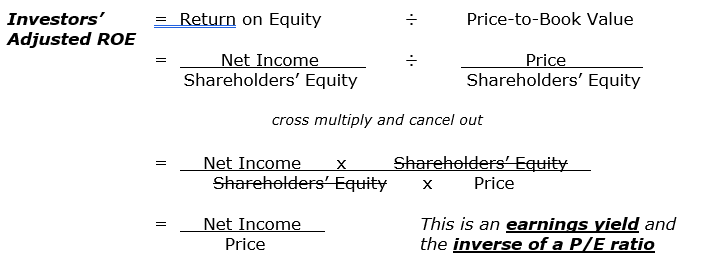

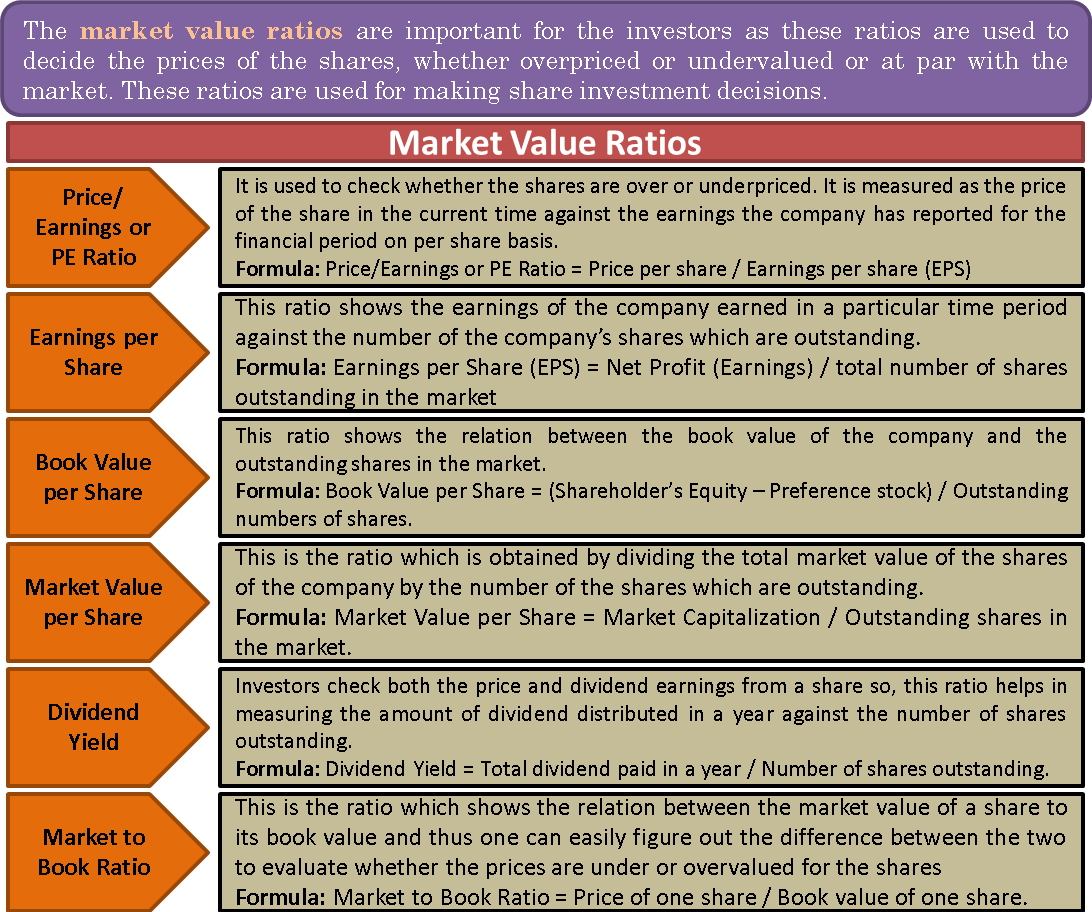

Price to book ratio meaning. The ratio denotes how much equity investors are paying for each dollar in net assets. A stock s capitalization divided by its book value. It is calculated by one of the following two methods. Book value denotes the portion of the company held by the shareholders.

The price to book p b ratio is widely associated with value investing. The price to book ratio also called the p b or market to book ratio is a financial valuation tool used to evaluate whether the stock a company is over or undervalued by comparing the price of all outstanding shares with the net assets of the company. The price to book ratio measures a company s market price in relation to its book value. The idea behind value investing in the long term is to find the market sleepers.

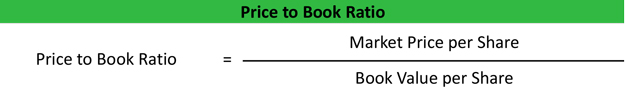

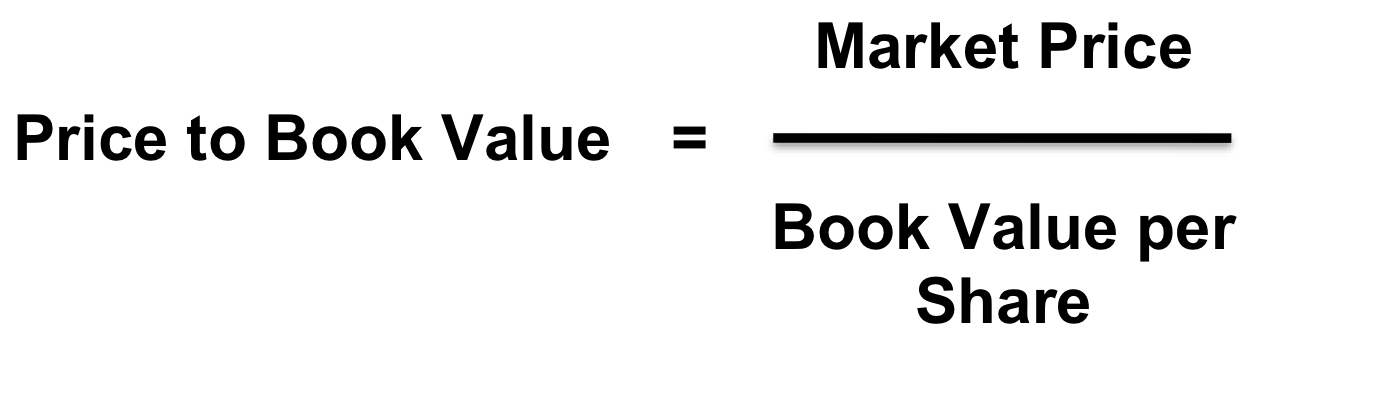

The value is the same whether the calculation is done for the. A price to book ratio of one means that the stock price is trading in line with the book value of the company. Companies use the price to book ratio p b ratio to compare a firm s market capitalization to its book value. Price to book ratio or p b ratio is used to determine the valuation of the company with respect to its balance sheet strength.

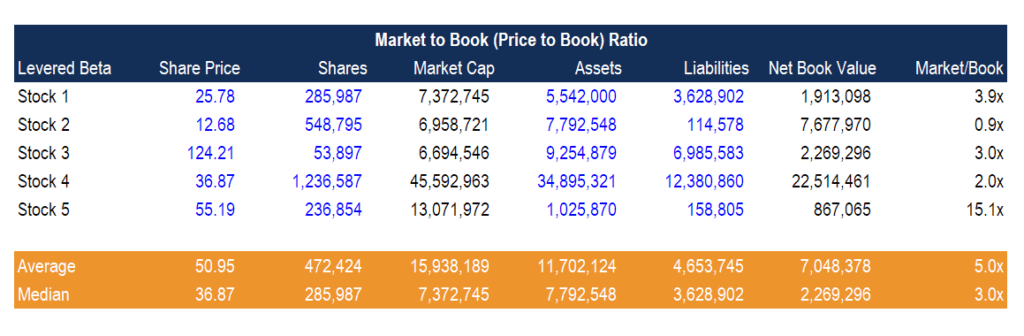

Price book value total market capitalization total book value. Book value is an accounting term denoting the portion of the company held by the shareholders at accounting value not market value. Price to book ratio price to book value is a financial ratio used to compare a company s book value to its current market price. In other words the company s assets less its total liabilities.

Definition of price to book ratio. The price to book ratio or p b ratio is a financial ratio used to compare a company s book value to its current market price and is a key metric for value investors. Defining price to book ratio simply put the price to book ratio or p b ratio is a financial ratio used to compare a company s current market price to the book value. A p b ratio with lower values particularly those below one are a signal to investors.

/pbratio-38e5cff99f884633a152df2a61dcb31e.jpg)

:max_bytes(150000):strip_icc()/value1-107161a22cc34fd49e87774a117fb504.jpg)