Price To Free Cash Flow Ratio Formula

Price to cash flow ratio price per share cash flow shares outstanding for example let s assume that company xyz has a share price of 3 and has 10 000 000.

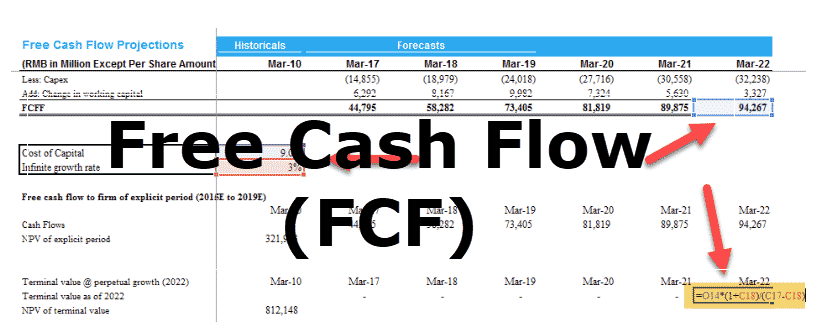

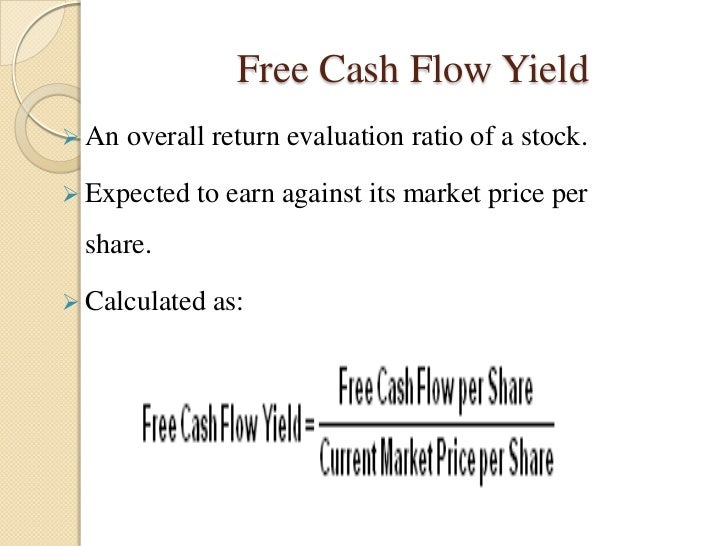

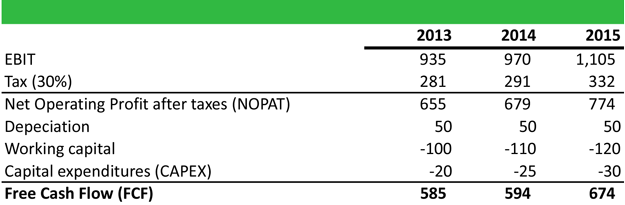

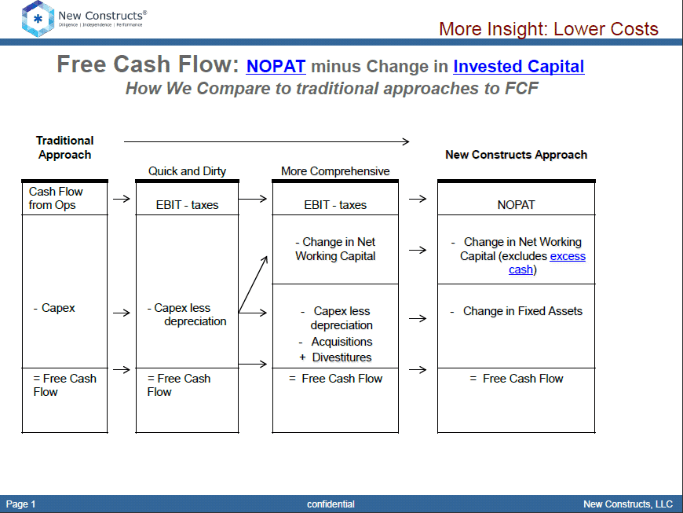

Price to free cash flow ratio formula. The formula for the price to cash flow ratio is. Price to free cash flow market capitalization free cash flow for example let s assume that company xyz has 10 000 000 shares outstanding which are trading at 3 per share. The formula for the price to free cash flow ratio is. It is a valuation metric which indicates the worth of the company based on the cash flow generated by it.

Or equivalently divide the per share stock price by the per share operating cash flow. First the multiple can be calculated using the company s market capitalization. Understanding these two ratios will help us figure out how to calculate the price to cash flow ratio for an investment. A general measure of the company s ability to pay its debts uses operating cash.

The price cash flow ratio also called price to cash flow ratio or p cf is a ratio used to compare a company s market value to its cash flow it is calculated by dividing the company s market cap by the company s operating cash flow in the most recent fiscal year or the most recent four fiscal quarters. Price to free cash flow ratio can be affected by companies manipulating the statement of their free cash flow on financial statements by doing things such as preserving cash by putting off. Formula to get a thorough idea about this ratio we need to look at two separate ratios. The price to cash flow ratio provides a shortcut for finding companies that have been undervalued in comparison to their cash flows.

Let s look at the price to. The price to cash flow ratio p cf is a profitability ratio that compares the price of a company to the underlying cash flow. The price to cash flow ratio is a stock valuation indicator or multiple that measures the value of a stock s price relative to its operating cash flow per share. Lets discuss more about the formula assumptions and interpretation of price to cash flow ratio.