S P 500 P E Ratio Current

S p 500 earnings per share ttm is at a current level of 116 33 down from 139 47 last quarter and down from 134 39 one year ago.

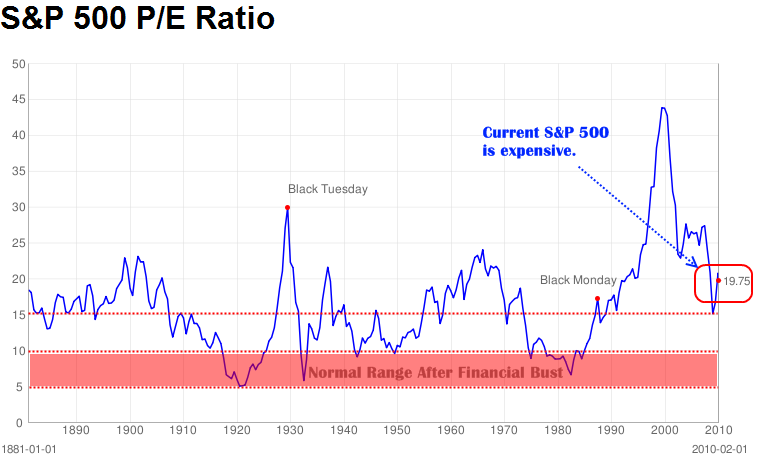

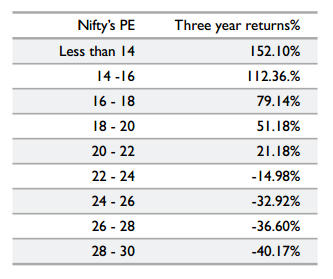

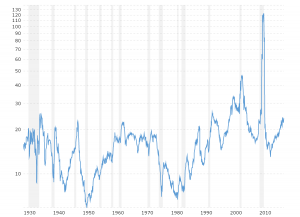

S p 500 p e ratio current. This indicates that the market is over valued. S p 500 pe ratio chart historic and current data. Market indices and statistics. Current s p 500 pe ratio is 29 70 a change of 1 08 from previous market close.

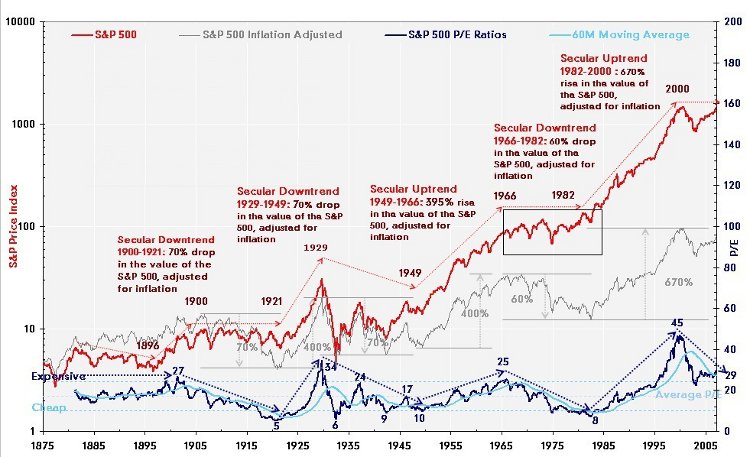

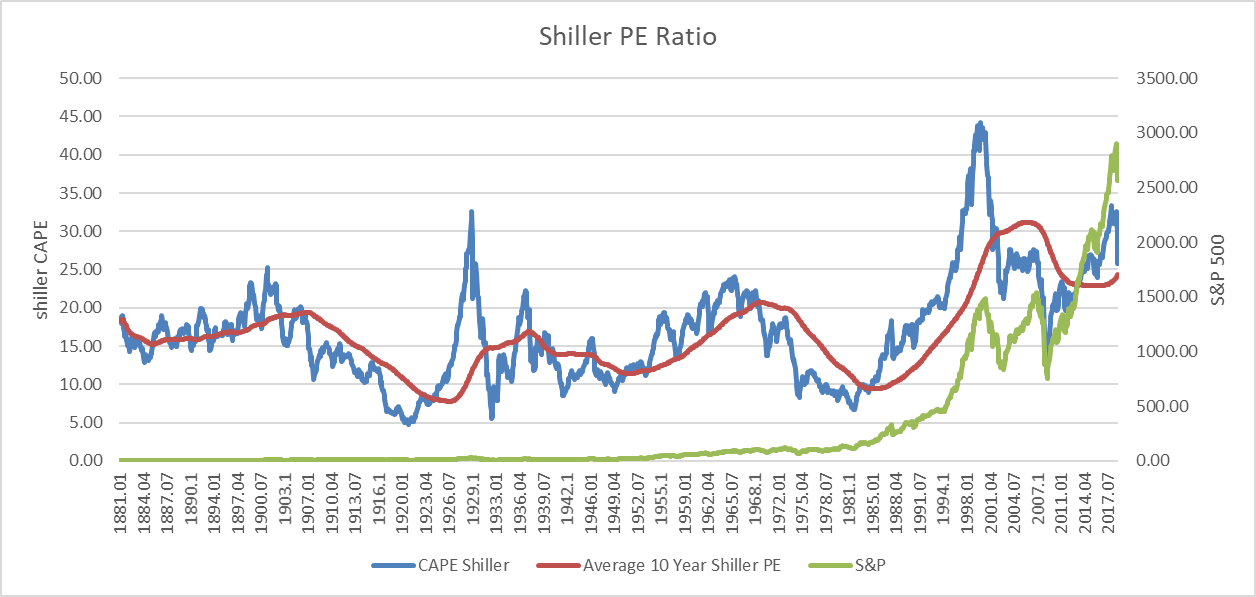

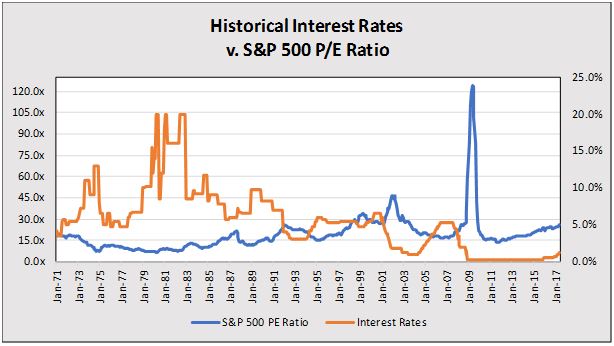

This is a change of 4 09 from last quarter and 5 34 from one year ago. S p 500 pe ratio 90 year historical chart this interactive chart shows the trailing twelve month s p 500 pe ratio or price to earnings ratio back to 1926. S p 500 pe ratio. Price earnings ratio is based on average inflation adjusted earnings.

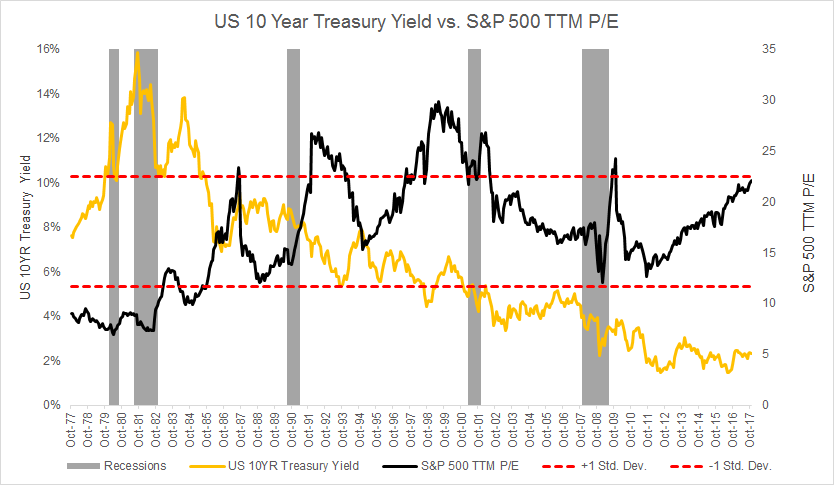

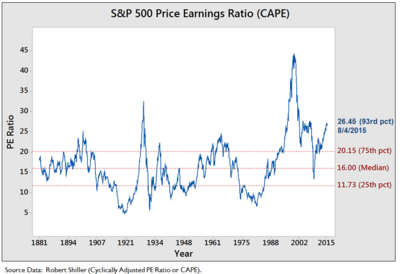

Current s p 500 pe ratio is 29 46 a change of 0 24 from previous market close. Shiller pe ratio chart historic and current data. Shiller pe ratio for the s p 500. S p 500 p e ratio is at a current level of 22 22 down from 23 16 last quarter and up from 21 09 one year ago.

Backlinks from other websites are the lifeblood of our site and a primary. S p 500 index 37 92 22 95 25 64 1 77 1 93 trailing 12 months forward 12 months from birinyi associates. Current shiller pe ratio is 31 47 a change of 0 26 from previous market close. The s p 500 pe ratio is the price to earnings ratio of the constituents of the s p 500.

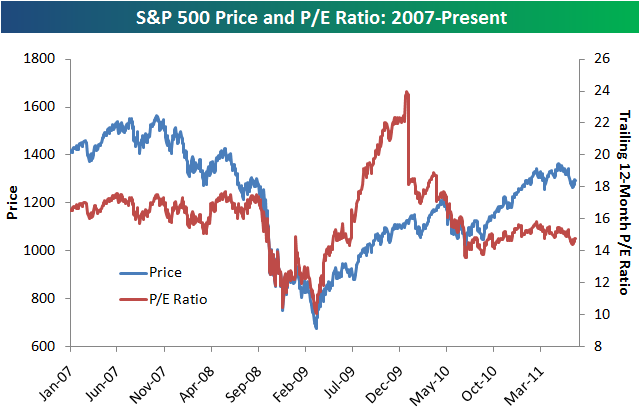

Estimate data based. Current s p 500 pe ratio is 30 76 a change of 0 45 from previous market close. The current s p500 10 year p e ratio is 32 2 which is 64 above the modern era market average of 19 6 putting the current p e over 1 standard deviation above the average. In 2009 when earnings fell close to zero the ratio got out of whack.

P e data based on as reported earnings. S p 500 pe ratio. The pe ratio of the s p 500 divides the index current market price by the reported earnings of the trailing twelve months.