Term Structure Of Interest Rates And Swap Valuation

Guide to simple dcf valuation excel ama leveraged finance analyst at a bb.

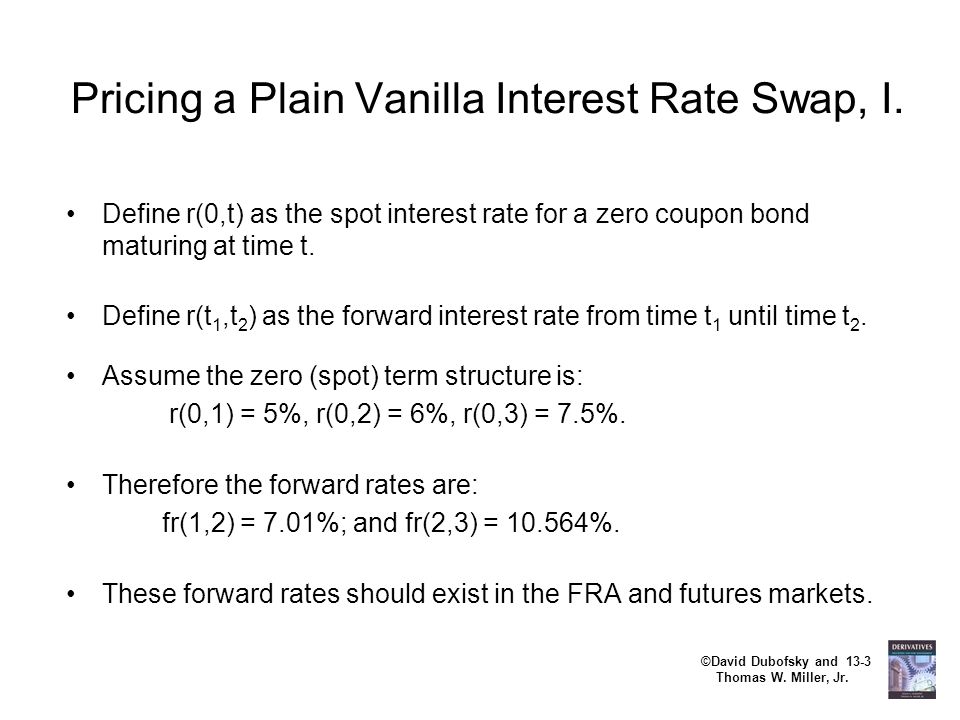

Term structure of interest rates and swap valuation. S1 s2 s3 s4 s5 s6 7 0 7 3 7 7 8 1 8 4 8 8 what is the discount rate. Term structure of interest rates and swap valuation suppose the current term structure of interest rates assuming annual compounding is as follows. S1 s2 s3 s4 s5 s6 7 0 7 3 7 7 8 1 8 4 8 8. Term structure of interest rates and swap valuation.

S1 s2 s3 s4 s5 s6 7 0 7 3 7 7 8 1 8 4 8 8 what is the discount rate d 0 4. S1 s2 s3 s4 s5 s6 7 0 7 3 7 7 8 1 8 4 8 8 what is t. Term structure of interest rates and swap valuation suppose the current term structure of interest rates assuming annual compounding is as follows. Suppose the current term structure of interest rates assuming annual compounding is as follows.

What is the fixed rate of interest that will make the valueof the swap equal to zero. Suppose the current term structure of interest rates assuming annual compounding. S1 s2 s3 s4 s5 s6 7 0 7 3 7 7 8 1 8 4 8 8. Swap ratessuppose a 6 year swap with a notional principal of 10 million is beingconfigured.

Term structure of interest rates and swap valuation suppose the current term structure of interest rates assuming annual compounding is as follows. Term structure of interest rates and swap valuation suppose the current term structure of interest rates assuming annual compounding is as follows. Term structure of interest rates and swap valuation. What is the discount rate eq d 0 4.

Interest rates are both a barometer of the economy and an instrument for its control. You should use the term structure of interest rates.